In today’s dynamic business landscape, staying ahead of competitors requires more than just a great product or service. It demands insight — actionable intelligence gleaned from reliable sources. One powerful method businesses are leveraging is the competitive teardown with public data. This technique involves dissecting and analyzing a competitor’s business strategy, marketing, operations, and product offerings using only data that is publicly available.

What is a Competitive Teardown?

A competitive teardown is a comprehensive process in which a business or analyst examines a rival company’s publicly observable operations. The goal is to understand the competitive landscape, uncover strategic moves, and identify potential risks and opportunities. Traditionally used by engineers and marketers in product development, teardowns now span a wide array of business functions, including pricing, distribution, PR, and technology infrastructure.

Why Use Public Data?

Public data presents a legal, ethical, and budget-friendly way to gain insights into a competitor’s operations. Unlike proprietary or private datasets, which may carry access restrictions or privacy concerns, public data is readily accessible and can often be more than sufficient for identifying key strategic patterns. Sources include:

- Company websites: Product updates, blog posts, job listings, case studies

- Social media: Campaign announcements, partnerships, customer sentiment

- Patent filings: Innovations and technological direction

- Financial reports: Revenue streams, cost structures, profit margins

- Review sites: User feedback, feature gaps

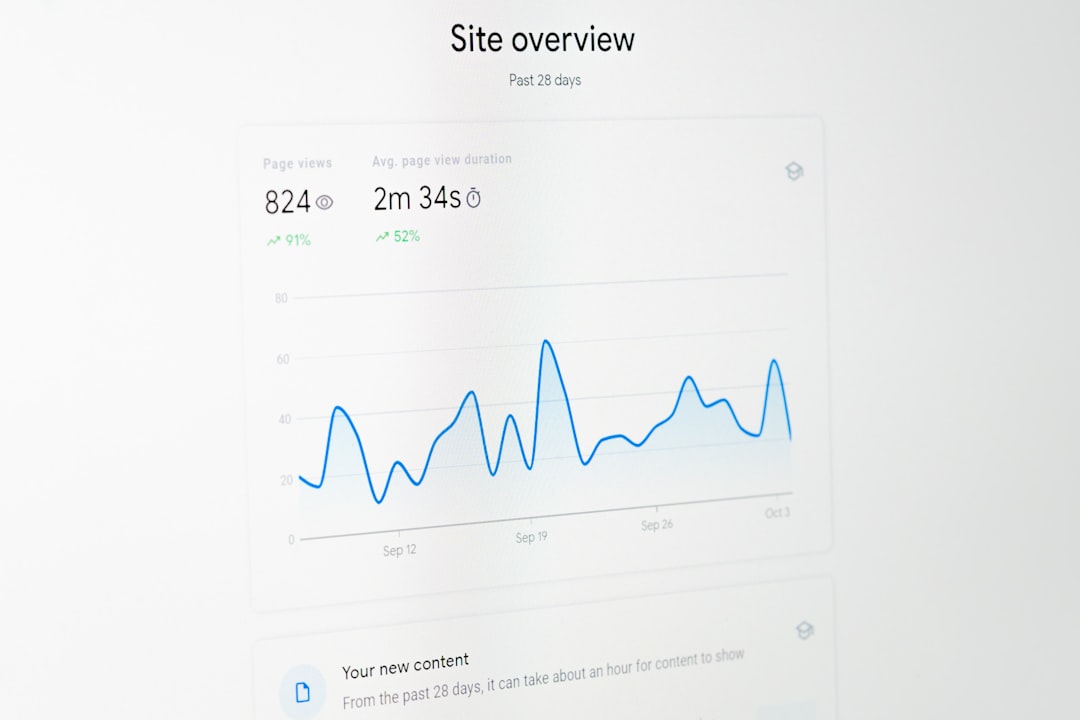

- Web traffic data: Market reach, user engagement

Key Components of a Competitive Teardown

While every teardown will vary depending on the industry and target company, certain core elements remain vital across fields.

1. Product & Feature Analysis

This includes a detailed breakdown of the competitor’s products — their user interface, feature set, pricing model, and package tiers. Through the lens of public data (like product manuals, demos, and online reviews), businesses can uncover what customers love or dislike about a competitor’s offerings.

2. Market Positioning and Messaging

Analyzing how competitors portray themselves in the market, including their value proposition, tone of voice, and emotional appeals in marketing, can provide clues into which audience segments they’re targeting. This involves dissecting websites, ad copies, press releases, and blog articles.

3. Customer Sentiment and Reviews

Public review sites such as G2, Capterra, Trustpilot, and social media platforms host a wealth of qualitative data. Sentiment analysis of customer opinions highlights perceived weaknesses or strengths, often revealing unmet needs that can be exploited competitively.

4. Technology Stack

What tools and technologies a company uses can be indicative of their priorities and future plans. Websites like BuiltWith or Wappalyzer help determine which CRM, CMS, CDN, analytics platforms, or ad tech stacks are currently in use by a company.

5. Hiring Patterns and Job Listings

By tracking the kinds of roles a company is hiring for and in which departments, one can identify areas of growth, investment, or internal challenges. Public job boards such as LinkedIn and Indeed offer this data in real time.

6. Financial Performance

For publicly traded companies, quarterly earnings calls, SEC filings (10-Ks/10-Qs), and investor reports provide deep insights into business health, investment areas, and forecasts. For private firms, indirect signals may come from business databases like Crunchbase or PitchBook.

How to Conduct a Competitive Teardown Using Public Data

The process of a teardown can be methodical. Here’s a step-by-step approach to conducting one effectively:

- Identify Competitors: Determine your direct and indirect competitors, categorizing them by market share, operational size, and market overlap.

- Define the Goals: Are you trying to improve pricing? Discover new features? Map market gaps? The purpose will shape what data you emphasize.

- Gather Data: Utilize web scraping tools, public databases, APIs, and manual research to collect data efficiently.

- Organize and Analyze: Use spreadsheets, dashboards, or software tools to visualize and compare data along important KPIs.

- Synthesize Findings: Create a report or presentation summarizing major insights, opportunities, threats, and actionable steps.

Tools and Resources for Teardowns

A successful competitive teardown often relies on a combination of free and premium tools. Here’s a curated list:

- SimilarWeb: Website traffic analytics and engagement data

- Ahrefs / SEMrush: SEO strategy, keyword performance, backlink profiles

- Wappalyzer / BuiltWith: Analyze tech stack and integrations

- Crunchbase: Financial and funding round details

- Looker, Tableau: For data visualization and competitive comparison

- LinkedIn Insights: Talent insights and hiring trends

Ethics and Competitive Intelligence

While competitive intelligence is a valid tactic, it must be gathered with integrity. Avoid grey areas such as scraping sensitive login-restricted data or deceitfully accessing private groups or repositories. Relying solely on public data reduces legal risk and ensures ethical boundaries are respected.

Limitations of Public Data Teardowns

Despite its advantages, public data teardowns have their limitations:

- Incomplete data: Key metrics may be hidden (like churn rate, CAC, LTV)

- Time-consuming: Manual analysis can take substantial time and effort

- Delayed signals: By the time data appears publicly, the strategy behind it may have already evolved

Nevertheless, these drawbacks are often offset by the breadth of information available for free and the insight it can generate when collected and interpreted properly.

Future of Competitive Teardowns

The rise of AI-powered analytics tools and data aggregators is turbo-charging public data usage. Pattern recognition, natural language understanding, and automated sentiment analysis are allowing teams to run teardowns faster and more frequently. In the future, these projects may become embedded into daily business operations and real-time strategic monitoring, offering firms a continuous edge in their competitive arenas.

FAQ – Competitive Teardowns with Public Data

- What industries benefit most from public data teardowns?

- Primarily tech, SaaS, eCommerce, and finance, but nearly every industry can leverage public data to understand rivals’ strategies.

- Is using public data for competitive teardowns legal?

- Yes, as long as the data is acquired from publicly accessible sources and not obtained through unethical methods.

- How often should companies run a teardown?

- Quarterly is common, but for fast-moving industries, a monthly competitive pulse using automation can be advantageous.

- How can I validate insights gathered through public data?

- Cross-reference multiple sources and, when possible, triangulate data with interviews, surveys, or third-party market research reports.

- Are there professional services that offer this?

- Yes, competitive intelligence firms and market research agencies offer teardown reports, though many in-house teams now run their own tools.

In the end, the companies that can observe, interpret, and act on public signals systematically through competitive teardowns are the ones that often stay one step ahead — and in a volatile market, that makes all the difference.